The AI-Based Claim Assessment App for Motor Insurance uses advanced machine learning algorithms to quickly and accurately assess motor claims, eliminating the need for a human surveyor, improving customer experience, and reducing claim settlement times. Enroll your company today to experience the future of motor claims!

Our AI-based claim assessment app for motor insurance is revolutionizing the way claims are processed. Using advanced machine learning algorithms, it enables insurers to quickly and accurately assess motor claims, saving time and improving the customer experience. With this app, a claimant can self-assess the damage to their vehicle and get an accurate estimation of the repair costs instantly.

CURRENT CHALLENGES

- The current process of motor claim assessment involves a physical survey by an insurance company surveyor, which can be time consuming, inaccurate, and prone to mismanagement of information.

- The delay in the survey can cause a delay in the claim processing, leading to customer dissatisfaction.

- The information collected during the survey is often inadequate and incomplete, leading to inaccurate claim settlements.

- The manual processing of the claim can result in errors and delays,leading to increased operational costs for the insurance company.

Features

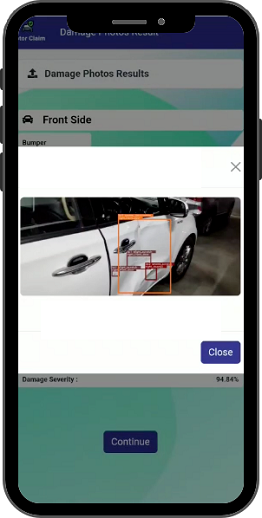

01. Part Classification

The app accurately classifies damaged parts,

such as the left mirror, right fender, headlight etc.

02. Severity Assessment

The app assesses the severity of the damage,

thus help analyse the level of repair needed or

replacement needed.

03. Tariff Based Integration

The app integrates with the tariff database to

provide accurate pricing information for the

damaged parts and labor costs.

04. Instant Estimation

The app provides an instant estimation of the repair

costs, enabling the insurer/claimant to make informed

decisions about the claim and take the next steps quickly.

05. AI-Based Claim Assessment

Our app uses artificial intelligence to assess claims by

capturing external damages only based on photographs

taken by insured individuals, garage officials, agency

executives, or claim handling officials.

06. Call Center/Customer Support

Our product has 24/7/365 customer support available in

multiple languages. Insurers have access to call center

records in real-time.

07. Mobile App and Web Based

Our application has a mobile app available for download on

both iOS and Android platforms as well as accessible on

Google Chrome and Microsoft Edge web browsers.

08. Unlimited User ID’s

Our product allows the creation of multiple user IDs based

on roles so that both the mobile app and web app can be

accessed simultaneously and get high level of data security.

09. RealTime Photos, Geo & Time Stamp

Our product only allows real-time photos using the app and

not from the photo gallery. It also puts the geolocation and

timestamp every time a photo is taken.

10. Role Based Limited Access

Our product allows for access by multiple parties with the

option of limited access to each party, as mentioned in

the eligibility criteria.

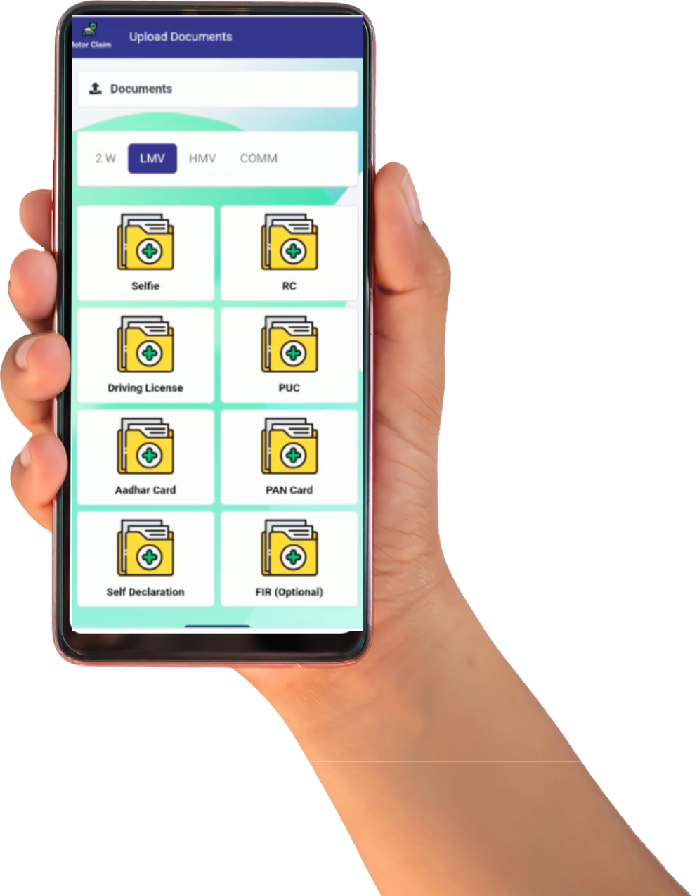

11. Online Document Verification

Our product allows for online verification of vehicular

documents and driving licenses from the

website/repository of the concerned authorities. A

supporting PDF is also generated.

12. Inspection App Link

Our service provider sends the inspection/app link to the

insured/workshop/others within one hour of

deputation/intimation.

13. Assessment Report Generation

The assessment report is submitted within two hours from

the time of uploading photos/videos by the customer/

workshop.

14. MIS and Role Based Reports

Our product has the ability to generate MIS on various

aspects such as TAT at various levels of claim processing,

claims settled against vehicle types, brands, geography.

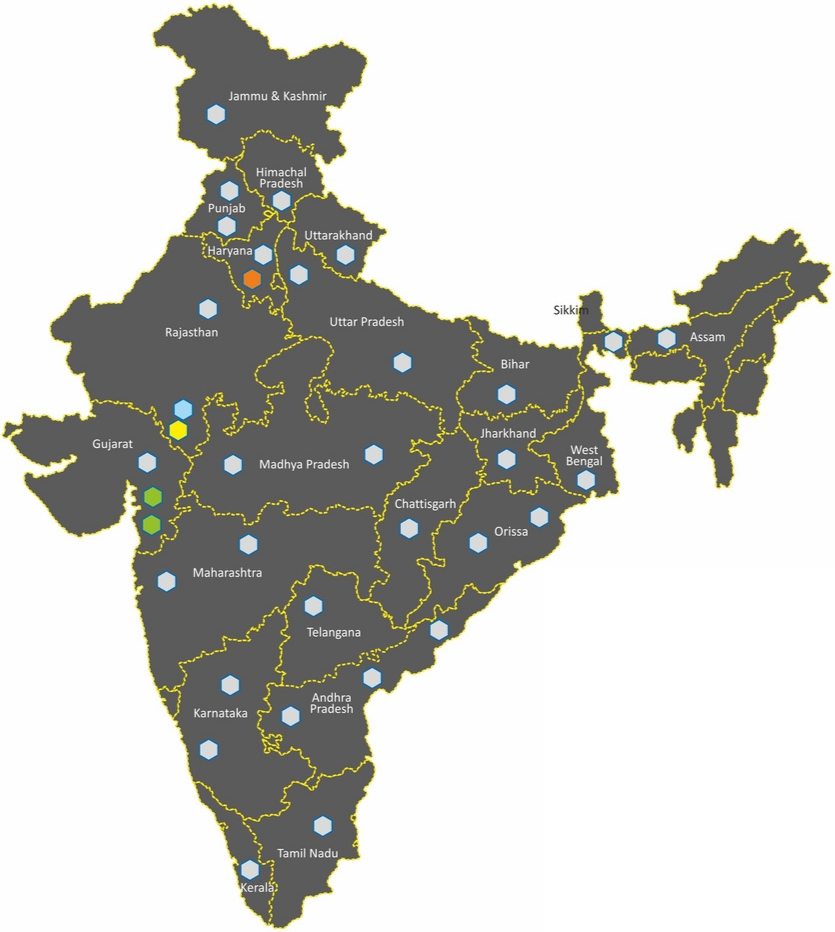

15. Pan-India Presence

We are present PAN India and have the capacity to service

National Capital Region (NCR), Mumbai and its urban

agglomerations, Chennai and its urban agglomerations, Kolkata and its urban agglomerations, Bangalore and its urban agglomerations.

16. API Based – Integration

The product offers API integratability, allowing insurers to

integrate the app’s features into their existing systems

and workflows seamlessly. This enables them to

streamline their claim processing and management

processes, reduce manual effort and errors, and provide

a better customer experience.

17. FaceMatch and Electronic Signature

Our product has the ability to perform a face match of the

driver with the driving license and take an electronic

signature from the screen of the mobile phone.

Conclusion

Our AI-based claim assessment app for motor insurance is a game-changer in the insurance industry. It uses advanced machine learning algorithms to quickly and accurately assess motor claims, improving the customer experience and reducing claim settlement times. With the added features of API integratability and real-time dashboard access, our app offers even greater efficiency and ease of use.